Financial Literacy Expedition: Money Doesn’t Grow On Trees

The Latin School Investment Fund (LSIF) enables students to gain financial literacy through experience, making the club one of the most practical extracurricular activities offered to Upper Schoolers.

By doing qualitative and quantitative analysis, anyone can engage with the market. Quantitative analysis—such as considering the total revenues of one company versus another, or comparing the relative valuation of stocks—is more concrete, but qualitative analysis plays an important role for a savvy investor. Qualitative analysis requires being an observant member of society and making thoughtful predictions about future trends.

LSIF started roughly five years ago when an anonymous donor gave Latin $50,000 for a group of students to invest in the stock market. Since its founding, the fund has grown to nearly $90,000.

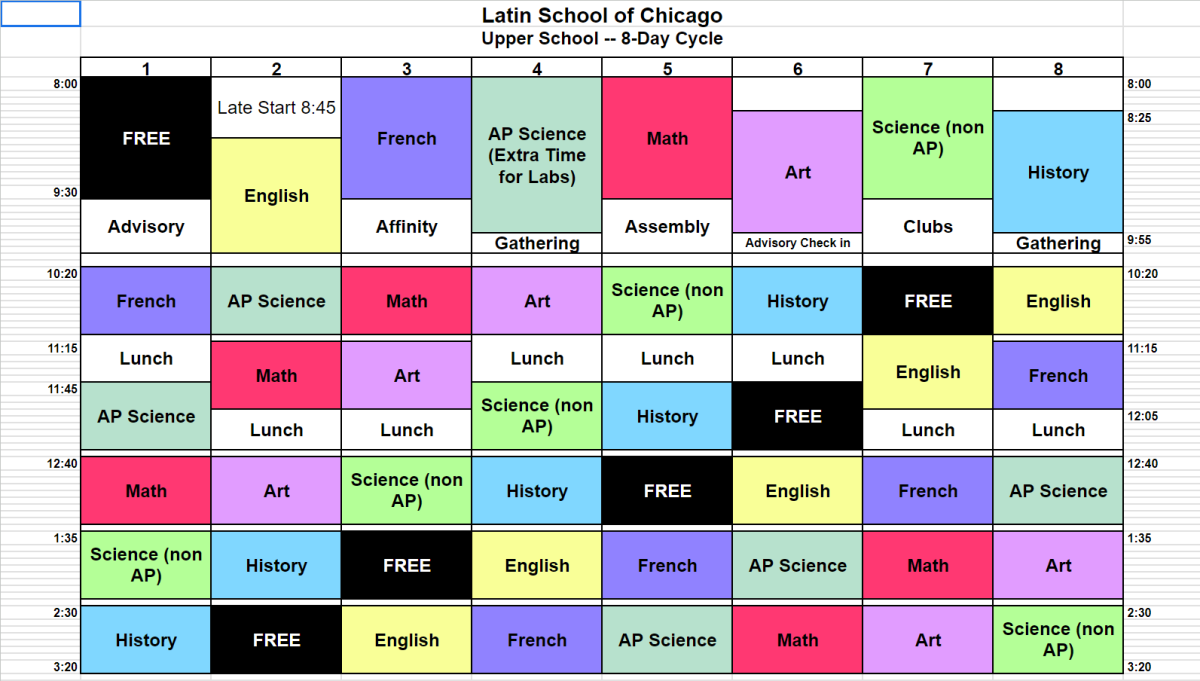

LSIF meets weekly, on Wednesday mornings at 7 a.m. Members are held to a strict attendance standard and are expected to contribute their thoughts and opinions at every meeting.

Unlike many clubs at Latin, students must apply to LSIF. The club is currently composed of 11 Upper Schoolers: five seniors, five juniors, and one sophomore. The application process requires that students pitch a stock and answer questions about various financial scenarios. Each applicant is given a variety of resources to study, and once all the applications are in, LSIF votes on the strongest pitches. The club strives for a diverse pool of perspectives and grade levels.

LSIF was founded on the idea that young adults should gain financial literacy because it is integral to people’s lives and so relevant in our society. Without exposure to this language, many people lack the confidence to manage their own finances, and this often leads to financial crises and ignorant decision-making.

Senior Sam Gibson joined LSIF in his junior year. “These financial lessons are crucial as they apply or eventually will apply to everyone’s life beyond school,” he said.

Senior Noah Giesen also praised LSIF. “We are in a time of our lives when we are about to go out and make real financial decisions,” he said, “and LSIF is a risk-free way to gain a ton of essential knowledge.”

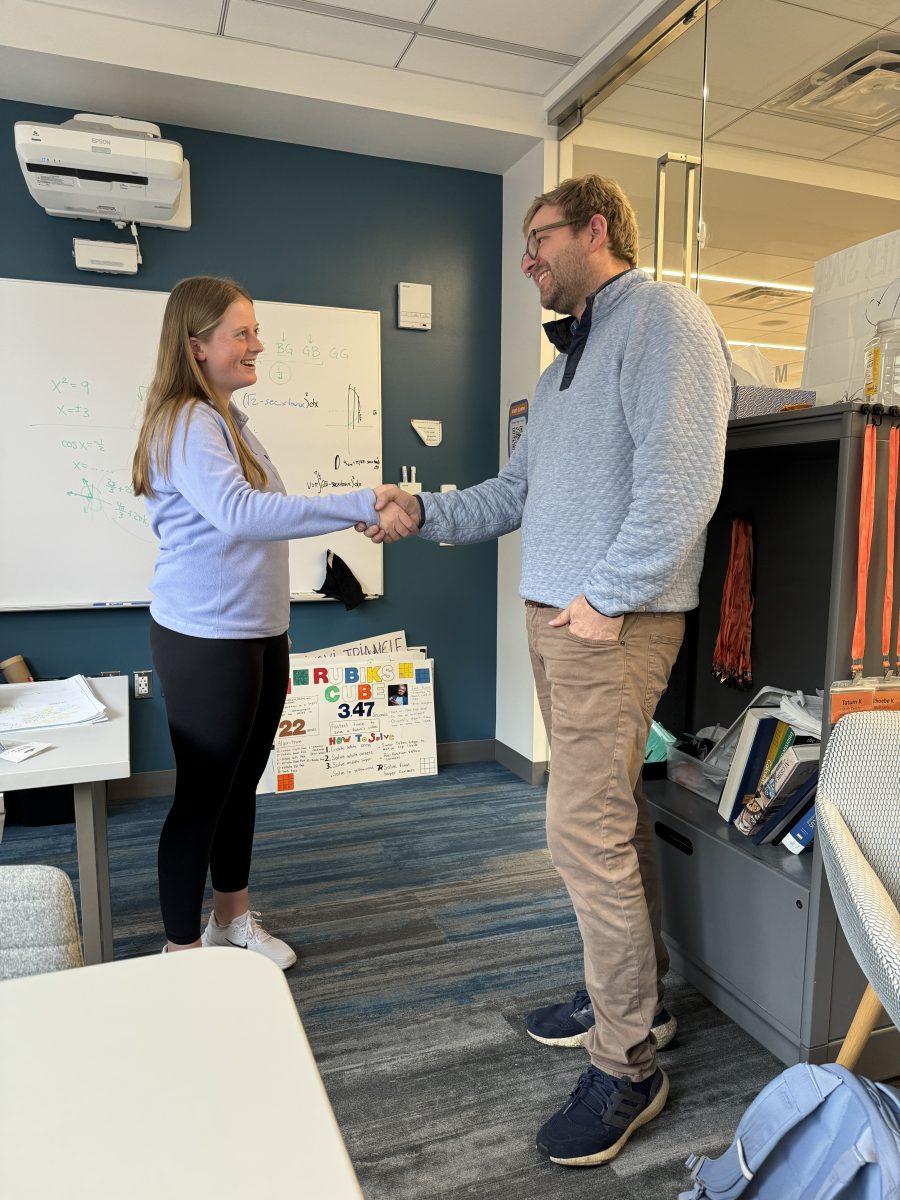

Upper School economics teacher and LSIF sponsor Tim Kendrick said, “To have that knowledge and understanding informs so much about the world around you, and it allows people to put themselves in the best positions for both employment and understanding government policy.”

If someone wants to go into finance, LSIF provides them with the tools and basic understanding to eventually pursue that kind of career. And for anyone, regardless of career choice, the fund offers the tools to make wise financial decisions, manage their own money, and control risk.

Though LSIF is somewhat selective, it is important that fund members are held accountable, because at the end of the day, real money is being invested. Students who don’t have the ability to join LSIF still have the opportunity to engage in finance outside of the portfolio. In some years, LSIF offers a training program that teaches investment skills, and Latin has a simulation investment competition called Champions of Wall Street. In addition, many Latin students are members of the Latin Business Club and Junior Economic Club of Chicago.

Aside from the finance skills learned in LSIF, the nature of this fund forces students to voice their opinions even when they are in the minority. Communication, collaboration, and organization are key when investing as a team. The hands-on experience teaches students leadership and how to take calculated risks, all skills which can be applied outside the classroom.

Latin has the privilege and means to allow students to manage a part of the school’s endowment, but there are still ways that high school students from less-resourced schools can learn basic financial skills. Investing platforms such as Rapunzl, Pilot Trading, and Wall Street Survivor exist for the purpose of risk-free investing. Financial podcasts, books, news networks, and websites such as Yahoo Finance, Investopedia, and Forbes offer additional ways to engage with the market.

Every high school in the United States should empower students to learn financial literacy, and these lessons by no means require real money. Whether it is inside the classroom or in your free time, all you need is curious students and adults to spread the knowledge. Mr. Kendrick said, “Whether it be a required economics class or financial literacy club, high schools should all implement some financial requirements.”

Ana-Diesner Whittemore • Mar 18, 2022 at 3:08 pm

In our American society there is probably nothing more important than for developing young adults than to fully understand financial literacy no matter what their chosen life path.