President Donald Trump declared April 2 “Liberation Day,” a plan to increase U.S. tariffs on imported goods from much of the world. The announcement hit hard, with the S&P 500 Index falling 10% in two days, reducing the values of most investment portfolios, including those of much of the Latin community. Rumors of teachers having to postpone retirement after losing so much in savings began to float around. However, a few days later markets had a historic rally when Trump repealed his tariffs on much of the world while continuing to target China.

President Trump started with a base 10% tariff plus individualized percentages on many nations, which supplements any previous tariffs on said countries during the current Trump administration. Some of America’s largest trading partners, such as China and Vietnam, were at the top of the list. Many inexpensive goods in the U.S., including school supplies and textbooks, are manufactured in Asia, as are computer chips needed for the laptops students are required to purchase before their freshman year. Tariffs will raise prices on those items as well as on daily essentials not all students can afford to pay extra for.

But most of all, the announcement of the tariffs caused chaos in the markets. Although the damage has mostly been repaired, the uncertainty and spontaneity of Trump’s tariff plans have panicked investors and caused an especially volatile market, affecting both students and faculty at Latin with hard hits to even the most diverse portfolios.

The Latin community is home to many clubs centered around investing and finances, some of which have thousands of dollars that, for the average investor, would have lost over 12% in six days. Latin’s student body has many traders, both hobbyists and more serious individuals, with large sums of money in volatile assets. Faculty and staff could rely on invested money to finance their lifestyles or retirement. If 12% of that money just disappears, it could be devastating.

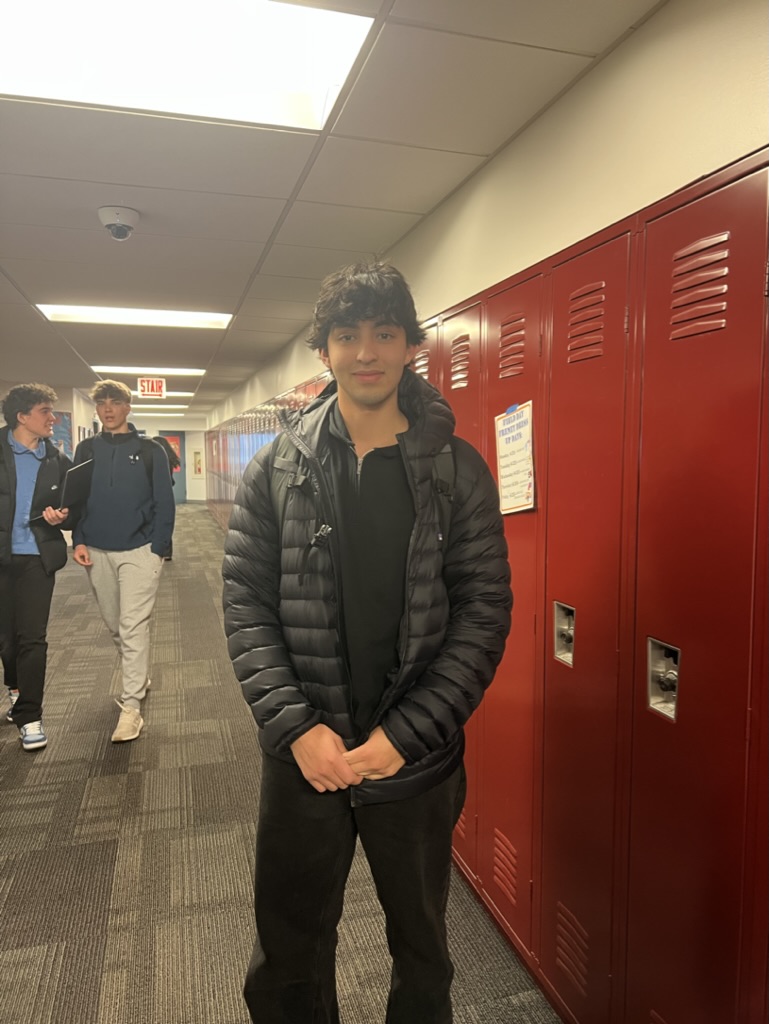

Sophomore Alex Stamos managed to minimize the damage, but he didn’t escape unscathed. Although most of his portfolio belongs to holding stocks (long-term investments aimed at capitalizing on general market growth), his investments in the technology sector were substantial. “I was holding on to some Apple stock, and in addition to that, I had one share of Nvidia,” he said. “So I decided to sell those as soon as I saw the announcement. And that really saved me a lot. Regardless, I was still hit hard.”

Alex adds that this plummet was just the beginning—once the tariffs’ effects reach companies, stocks might once again crash.

“It was really hard to navigate, and I did end up losing money, but I’m confident with the current portfolio I have, since most are pretty stable stocks that aren’t really affected by the tariffs,” he said. “Some of them definitely will take a substantial hit, other ones will be fine.”

Stable stocks might look different during this period of economic turmoil. Companies selling services or producing domestically will likely see less impact from the tariffs. Normally, blue-chip stocks are considered the most stable, but investors may shift toward domestic businesses and away from large multinational companies in the wake of the tariffs.

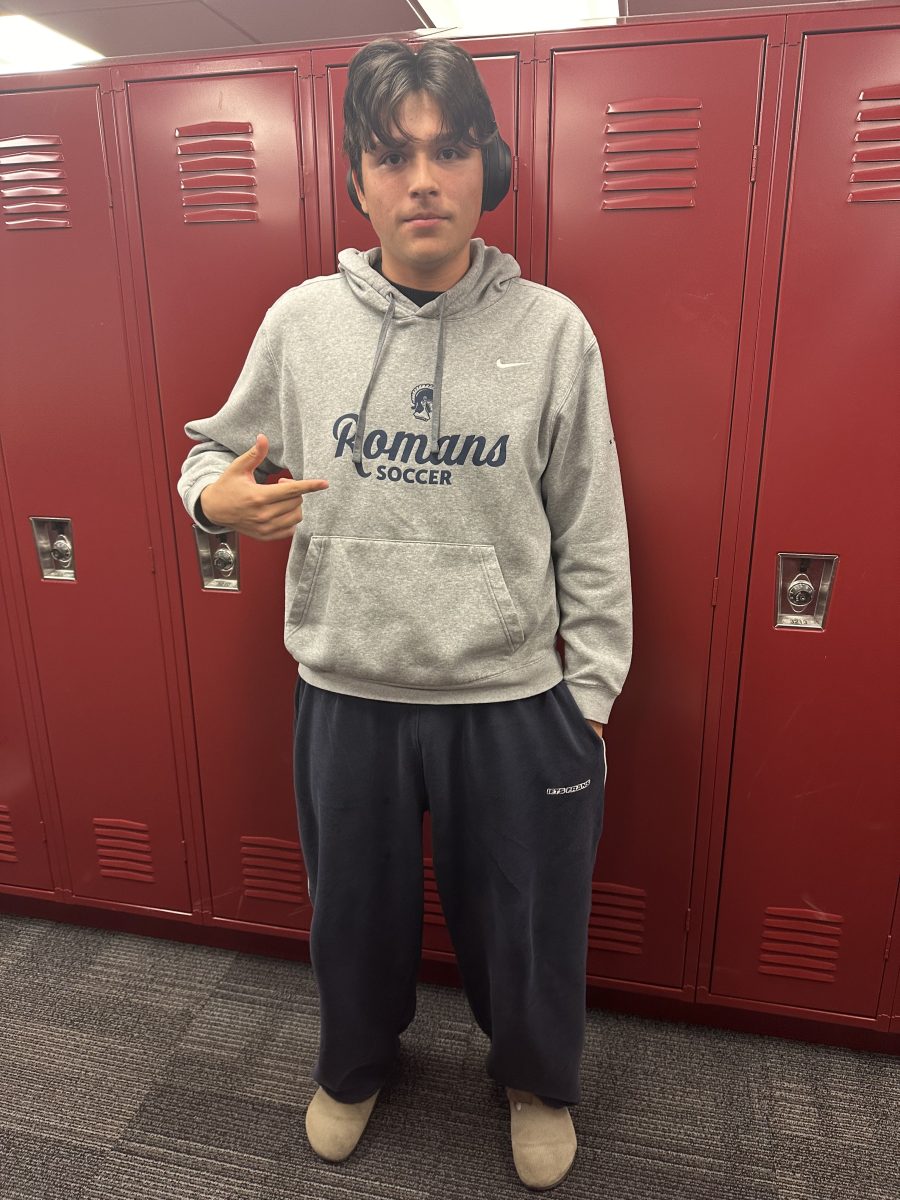

Junior Tim Kempton thought his portfolio of stable stocks would hold up against the market.

“On the day of April 3, I lost a little bit more than 6%, which was on par with the market. In the past five days, I have lost around 14%, which is around 4% worse than the market,” he said “This means that I need about 15% in gains to make back these losses, which could take a while, especially in the current climate.”

Despite those numbers, Tim said he isn’t too worried about his own portfolio. “I have so much time to make back these losses, and they don’t even cancel out the gains of the past year,” he said. “I feel awful for the people who had a sizable chunk of their retirement savings wiped out in one day, and now might have to work another few years to retire.”

Upper School science teacher Steven Coberly plans to retire at the end of this school year. Though he believes his timeline won’t change, he is worried about what an affordable standard of living might look like after “Liberation Day.”

“I try not to look at my accounts every day, but I think over the year, it’s down some 15% or so. And does that affect your ability to retire, your ability to afford stuff,” Mr. Coberly said. “I might have to, depending on how my investments are doing, adjust my standard of living at some point in the future to make sure I have [enough] money to make it until I’m dead. But I didn’t expect to have to already be making those calculations and having those thoughts before I even got to retirement.”

The problem for Mr. Coberly isn’t just losing money—it’s not having the time to make it back before retiring.

“It’s kind of painful to think about having to withdraw from [retirement funds] now, when the market is down so much that not only am I taking money out, but there’s now less money in there that could actually grow,” he said.

With the mere threat of tariffs having such a negative impact worldwide, many are wondering why President Trump wants them in play. While his true motives often remain unclear, some speculations stem from the tariffs’ framing as “reciprocal.” The administration claims to be calculating precise costs of foreign tariffs on American goods and responding with equal measures to protect American businesses.

Upper School history teacher Debbie Linder said that the tariff calculations are less a measure of foreign taxes on U.S. goods and more an erratic equation. “The argument is that reciprocal tariffs are based on tariffs that [other countries] already have against us,” she said. “How they measure those tariffs is arbitrary. We have many organizations in our government who actually do the numbers and would give [President Trump] the information needed if he gave them the time. What he did was make some guesstimates, which is really unusual for the United States.”

Though the market’s sudden drop hit many hard, Trump minimized damages by postponing most of the tariffs, sparking a historic rally across sectors. The administration did not, however, repeal tariffs against China, instead raising rates to 145% in response to China matching the U.S. with similar rates on American goods. China reacted immediately by raising tariffs against the U.S. to 125%.

Trump’s postponement of some of the tariffs is just that: a pause. If the tariffs are ultimately imposed, they will hit companies hard, making products more expensive and less attainable for consumers in the U.S.

Americans rely on a general stream of foreign goods—everything from rare earth minerals to rice. Ms. Linder thinks destroying those dependencies is unfeasible. “There’s a reason why 90-plus % of economists say this is not a good idea,” she said. “We are so globalized. We are so interconnected. Everything is interwoven. It’s impossible to pull it apart. It’s like unraveling a sweater with threads from everywhere. And to re-weave that sweater is going to be really hard.”

Economists also say unweaving that metaphorical sweater would likely lead to a recession.

Upper School history teacher Grzegorz Gaczol believes that Trump’s tariffs could cause the panic needed for a recession.

“If people don’t have confidence in the way that things are running, you might not want to invest because you’re fearful that things are going to continue to turn bad,” he said “Then you’re starting to save money instead of spending, and if people don’t spend money, then suddenly businesses don’t make as much. They can’t afford to employ as many people. And the snowball effects continue.”

The only thing certain is uncertainty. Tariffs could be what the long-term American economy needs. But in the short term, their wavering presence is hurting Americans. Mr. Coberly said he wonders if it has to be this way. “This [drop] will correct itself at some point, but I feel like without the tariff nonsense, [the market] would be going up now. And I’m not sure it will ever catch back up to where it should have been, had Trump not instituted these crazy policies.”