Think Before You Tap!

Sophomore Kate Weiskirch using her phone to buy a tea at Potash.

In an increasingly digital world, traditional checks and dollar bills have gone out of style in favor of mobile payment apps like Apple Pay and Venmo. It’s no longer necessary to lug around a clunky wallet, as nearly all transactions can be made on a phone. However, this technology does not come without risks. With many students turning to their devices to pay, should the Latin student body be wary of using mobile payment apps?

On the one hand, these payment apps hold numerous benefits, including giving students the ability to more easily pay their friends and visit establishments near Latin on a moment’s notice. What would a Latin student do if they needed to repay a friend for lunch at Chipotle, for example? According to a survey conducted in 2022, the younger generation is more likely to use online banking and payment methods. While digital payments are more convenient in some aspects, they also come with potential danger.

Often, users are at risk of sending incorrect amounts of money, sending money to the wrong person, or falling for a complete scam. According to The New York Times, 18 million Americans were victims of mobile payment scams in 2020. Senior Elro Starr doesn’t see herself becoming a victim of any of these occurrences, though. “Chase Pay gives you a lot of confirmation screens, and I’m also a fairly careful person when it comes to money,” she said. “There’s a slight danger, but between all the safety measures, security, and common sense, I’m not worried.”

Upper School math teacher Edward Mahoney echoed Elro’s point about using common sense. “I’d say [Latin students] are coming in at a high level [of financial literacy],” he said. Mr. Mahoney teaches Finance & Math, where students learn about the American financial system and other everyday financial techniques, perhaps proving beneficial to students who use mobile payment apps.

Despite the financial literacy of most Latin students, Mr. Mahoney still expressed concern with students managing their finances online. “I think that sharing your sensitive data anywhere online is risky,” he said. “The world is moving in that direction, but it definitely exposes the student to some level of risk anytime that they’re connecting bank accounts or credit cards to any website.”

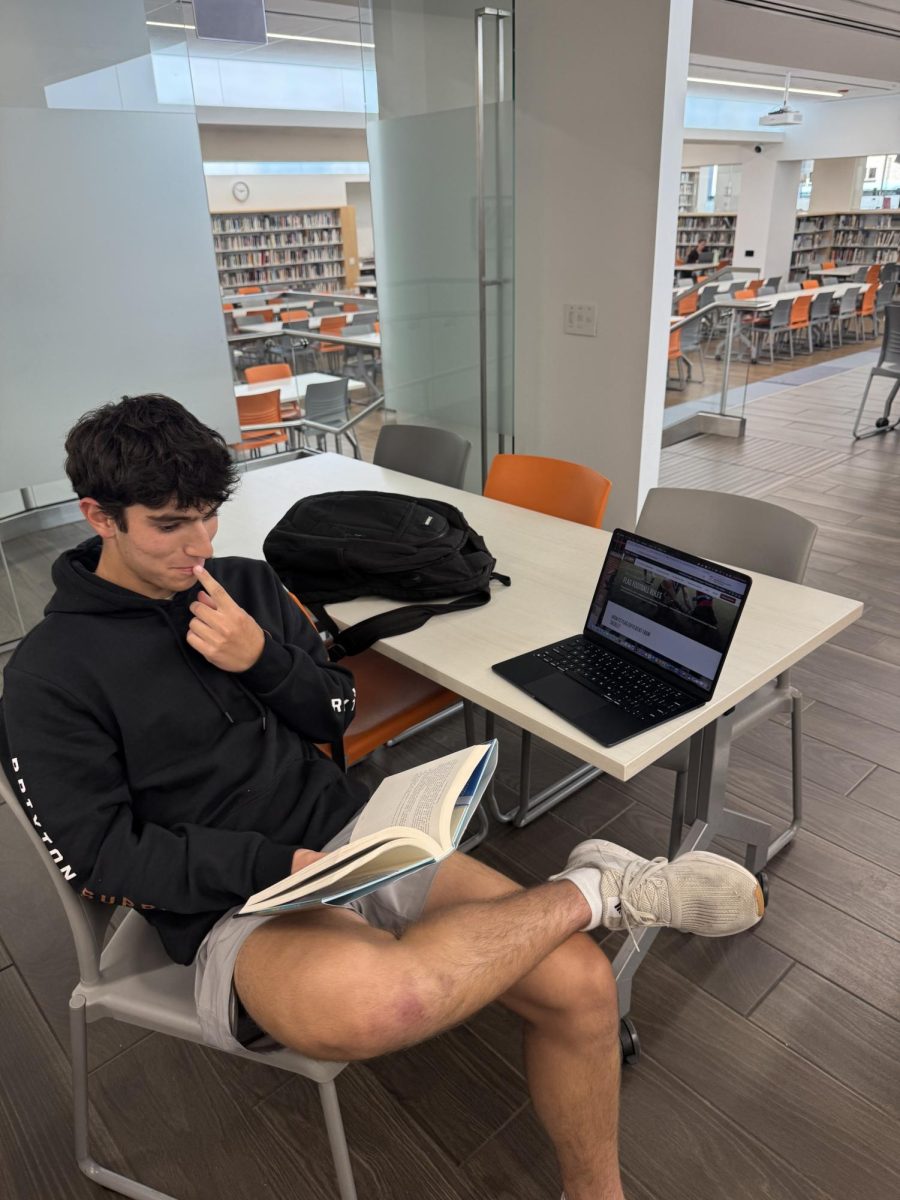

More recently, the most common way to pay is with Tap to Pay, which eliminates the need to swipe cards and allows transactions to be completed with a simple tap of one’s phone. Latin students can often be found paying this way at the school’s kiosks or at the nearby Potash Market.

Christy Huerta, the HandCut Foods employee who operates the kiosk adjacent to the Learning Commons, bears witness to some of the spending habits of students. According to Ms. Huerta, a majority of students pay with Tap to Pay. When asked if students confirm the item’s price before purchasing, Ms. Huerta said, “Not always, maybe one out of every five students.”

Mr. Mahoney also questions whether students practice full awareness when using mobile payment methods. He said, “I think oftentimes when you pay with apps or even with credit cards in comparison to cash, it feels less real. It’s easier, and that’s how it’s designed to be.”

Caroline McHugh (‘25) is excited to serve as an Editor-in-Chief this year! She loves writing on issues important to the Latin community—whether that...